Going Once ...

The industry has seen more acquisitions in the last 24 months than in the previous six years. Utilities are gaining scale and consolidating territories. Whole company acquisitions are an important part of the strategy of any company to grow and when well executed can provide much more than simple scale. However, it is not the only option to grow earnings. Asset acquisitions can provide another avenue for growth that should not be ignored. There are three main forces that will push the industry back to focusing on asset acquisitions in the next year.

We are approaching a point where there are fewer attractive acquisition prospects available, as the largest utilities become landlocked.

1) the decline of suitable whole company acquisition targets;

2) impending environmental regulations that will have a large impact on generation portfolios; and

3) the increasing difficulty of obtaining regulatory approval for whole company acquisitions.

These factors will turn the tide in favor of acquiring specific assets and pieces of companies in favor of buying companies outright.

Big is Beautiful

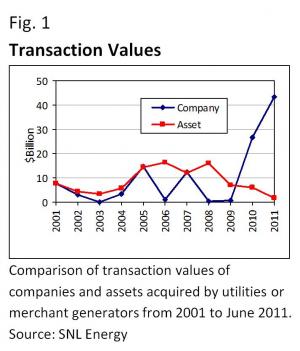

The recent upswing in whole company acquisitions vs. asset acquisitions is clearly seen in Figure 1 which shows total deal value by year for each type of acquisition (see all figures on p.2). The reasons for this surge in activity are multi-fold but revolve around the need for utilities to drive earnings-per-share (EPS) growth in a slow economy and the relative value seen in acquiring a whole company rather than individual pieces. However, we are approaching a point where there are fewer attractive acquisition prospects available, as the largest utilities become landlocked against equally large competitors. In fact, this trend of acquiring utilities in neighboring territories is so strong that it can be easily seen by looking at a map of territories of recent acquisitions.

Plant acquisition opportunities will be short-lived, as asset values increase due to planned generation retirements.

For many utilities the lack of these opportunities leaves targeted asset acquisitions as the best option for driving growth. Furthermore, the relative value of acquiring whole companies compared to assets is beginning to shift as utility values are recovering from the low seen in 2009. Earnings multiples are recovering following the recession where they went as low 10x as shown in Figure 2. Furthermore, utilities were reluctant to sell assets during the bottom of the recession due to relatively low valuations. Many of the asset-based transactions that occurred in this period were by companies in need of cash to shore up balance sheets.

Portfolio Shuffle

The next driver to consider behind asset acquisitions is the need for companies to replace generation assets as a significant portion of the U.S. generation fleet will likely be affected as a result of pending EPA regulations. The reasons for this to favor asset acquisitions are threefold: 1) many companies will need a source of cash to complete required environmental upgrades on their fleets making asset sales attractive; 2) companies retiring large portions of their fleet will want to replace retired generation in their portfolio; and 3) companies that are predominantly reliant on coal for generation will look to diversify their fuel sources to reduce the risk posed by future changes in regulations.

The EPA regulations currently under public comment have already prompted numerous utilities and merchant generators to announce retirements of over 20,000 MW of capacity between now and 2020. In addition, the final amount retired will likely be double or triple these initial announcements according to various industry analyses on the current version of proposed rules. When examining their options, many utilities will choose to acquire assets instead of building new generation due to the relative costs of these options as shown in Figures 3 and 4. However, it is anticipated that this opportunity will be short-lived as asset values increase due to planned generation retirements.

Clock is Ticking

The final force that will drive a shift to asset acquisition is the increasing difficulty of obtaining regulatory approval for whole company acquisitions. The pre-recessionary period showed a strong willingness for state legislators and regulators to interfere with announced acquisitions that they believed would be harmful to consumers. As the largest deals begin closing and integration activities begin, regulators will once again have the chance to observe the impact on jobs and ultimately the consumer. This likely will lead to increased resistance for future deals requiring costly concessions to gain regulatory or legislative approval. Although this sentiment should impact the sale of utility territories, it may be less severe if the acquirer already has a significant present in the state where the acquisition target lies.

The question on the minds of utility executives should be 'How do we prepare and benefit from this coming trend?' To do this, a utility must take a long-term look at its asset and customer portfolio, the anticipated changes in the industry landscape on its business, and the need to grow earnings to drive shareholder returns. Many will find that they should be on the sell and buy side in order to better balance a portfolio that was created by the merging and acquisition of utilities over the past decade. However, those utilities in a position to acquire should act quickly in order to realize the greatest benefit.

ABOUT THE AUTHORS: David Quiram (david.quiram@accenture.com) and Andre Begosso are senior managers in Accenture's management consulting resources practice. Robert Laurens is a senior executive in Accenture's management consulting practice.