Customer-Care Tipping Point

Consumer preferences for interaction have reached a tipping point and energy providers now have a compelling opportunity to fundamentally re-design the traditional interaction mix. The cornerstone of the redesigned interaction mix is developing a dual customer relationship. Successful providers will be those that drive low-value transactions to lower-cost channels while creating capacity to focus on delivering value-added service for a small set of interactions.

While self-service adoption has increased, many utilities don’t enjoy the high levels of adoption commonly seen in financial services and other industries.

To help energy providers understand the values and preferences that drive consumer behavior, in 2010, Accenture initiated a multi-year global consumer research program to explore consumer values, opinions and priorities related to energy conservation, interaction preferences and beyond-the-meter products and services. The findings of our latest consumer research released in 2012, Actionable Insights for the New Energy Consumer show that there are numerous opportunities for utilities to cost effectively maintain, and even increase, customer satisfaction while achieving cost-to-serve goals.

The exact channel mix may differ depending on channel costs, competitive intensity and mix of products and services offered. However, Accenture believes that about 30 percent of consumer interactions are suited to be higher touch and more personal in nature, while the other 70 percent of transactions can be managed in a low-touch and a relatively low-cost manner. For many providers, this is the reverse ratio to how interactions are managed today.

When it comes to self-service, consumers’ expectations have been set high, based on experiences with other industries.

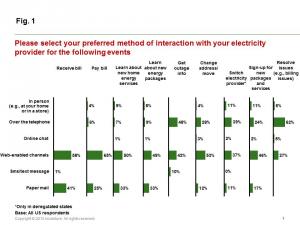

Driving adoption of self-service is one of the key aspects of redefining the interactions mix. Energy providers are keenly aware that implementing self-service solutions is critical to reducing operational costs and providing increasingly mobile and connected consumers with the tools they want. While self-service adoption has increased, many utilities do not enjoy the high levels of adoption commonly seen in financial services and other industries. The challenge of increasing rates of self-service has come into stark focus in the past years as challenging economic conditions continue to drive emphasis on the bottom-line for utilities that are increasingly challenged to do more-with less. However, consumer interest in self-service has reached a point where for nearly all major interactions, consumers prefer web-enabled channels (see Figure 1).

Transforming Self-Service

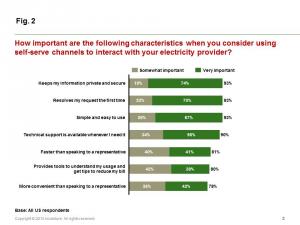

The range of expectations for self-service indicate that providers must create an experience that above all else gets the basics right. Consumers report that the most important aspects of self-service are privacy, first time resolution, ease-of use, and technical support available when they need it.

When it comes to self-service, consumers expectations have been set high based on experiences with other industries. While getting the basics right is critical, providing additional value in self-service channels is also important. When considering using self-service, eighty percent of consumers said it is important to provide tools to help understand usage and get tips on reducing their bill (see Figure 2). As energy providers develop effective self-service capabilities it is important to understand and address the full range of consumer expectations.

Creating Valuable Interactions

Reshaping the consumer interaction mix is not just about self-service. There are particular interactions where consumers prefer a higher-touch service approach. Accenture’s research shows that when it comes to more complex or sensitive interactions, such as resolving issues, consumers prefer direct interaction over the phone or even face-to-face. In our study, 62 percent of consumers prefer the telephone for resolving issues, and 39 percent for switching providers.

For providers that move beyond the meter, the channel mix becomes increasingly complex. In our 2011 consumer survey we found that over 60 percent of consumers would prefer to purchase an energy efficient product or a SetAndForget program from a salesperson in a store or at their home. (See “Revealing the Values of the New Energy Consumer,” Accenture, 2011.)

As a group, younger consumers present a special paradox for energy providers.

In particular the resurgence of face-to-face channels poses a challenge for many utilities in North America who often lack a physical service network. Innovative partnerships with established retailers is one way that providers are tackling this issue.

Taking a Targeted Approach

When considering channel strategies for the future a “one size fits all” approach will not suffice. Actionable Insights for the New Energy Consumer shows that consumers have differing preferences when it comes to interaction in particular when it comes to younger consumers. This group of consumers presents a special paradox for energy providers: US consumers aged 18-24 actually show a stronger preference for high touch channels such as speaking on the phone, when it comes to learning about new energy packages and services, as well as when switching providers. While it is true that all consumers show a preference for high touch channels in these cases, the difference in age groups is apparent. When learning about new energy packages 35 percent of consumers aged 18-24 prefer high touch channels, compared to a range of only 14-17 percent of consumers aged 35 and older; when switching providers in deregulated US markets, 63 percent of consumers aged 18-24 prefer high touch channels, compared to a range of 48-50 percent of consumers aged 35 and older. The unique preferences of younger consumers highlight the need for energy providers to take a targeted approach to creating a new interaction mix.

Getting Social

In recent years, many energy providers have begun to use social media to mine consumer sentiment, broadcast outage information and in some cases directly engage consumers. Social gaming applications centered on energy management are also emerging as a unique tool to create a new relationship some groups of consumers. Our research shows that 20 percent of consumers aged 18-24, and 17 percent of those aged 25-34 in the US show some interest in interacting with their electricity provider through social media.

Social media is increasingly becoming a viable channel and our research shows that consumers expect a two-way, value added interaction. When asked what would encourage them to interact with their electricity provider through social media, consumers reported that the most important factors were quick and convenient service, access to exclusive offers, and having an online community to discuss products and services or find ways to reduce their bills. For providers looking to engage consumers through social media, it’s clear that consumers have expectations for personal and value added interaction.

Shifting Preferences

Looking at the range of possibilities for interaction: mobile, social, web, in-person-it can seem overwhelming. Many energy providers have previously invested in channel strategies and development focusing mainly on reducing costs; however, there has not always been a holistic approach to aligning channel costs, organizational goals and consumer preferences.

Some customers are eager to interact with providers through social media, but they expect two-way engagement.

Our research and experience suggests that there are four steps that energy providers can take today to begin to redefine the consumer relationship:

1. Target basic low value, high-volume interactions for self-service. Consumer preferences indicate that in particular address change/moves, bill payment and even some forms of issue resolution can be handled online. Shifting interactions is one thing but energy providers must also ensure that on the back-end, self-service is truly automated and not creating additional work.

2. Identify true channel costs and focus on driving basic transactions to truly low cost channels. Some channels, like email may appear low cost but are in fact very expensive to manage issues to resolution. Providers require operational and channel reporting to drill into cost-to-serve and customer satisfaction levers at a detailed level across channels.

3. Develop a strategy for creating higher-value interactions. Depending on organizational goals: revenue growth, demand side management, customer satisfaction-specific interactions can be targeted for longer handle times and more personalized service.

4. Get social. Some consumers are eager to interact with providers through social media and based on their preferences, it’s clear that they expect two-way engagement. Providers must define objectives and strategies for social media while establishing governance that enables speed, agility and consistency of messages across social media and other channels.

Consumer preferences have shifted and energy providers now have the unique opportunity to redefine the traditional interaction mix in a way that drives operational cost reductions and customer satisfaction. Success requires a targeted approach that balances the interaction preferences of different consumer groups, channel costs and organizational goals.

ABOUT THE AUTHOR: Greg Guthridge is an executive-director with Accenture and the managing director for Accenture Retail and Business Services for Utilities, Nicholas Handcock is a manager who leads Accenture’s New Energy Consumer Research program for the utilities industry, Qaid Damji is a business analyst with Accenture management consulting practice.