Cheap Gas Forever?

When NYMEX closed on Tuesday, Sept. 27, Henry Hub natural gas spot prices were $3.92 per MMBtu. 24 months earlier in June 2009, the same spot prices ranged between $3.50 and $4.20 per MMBtu. Other than seasonal spikes due to increased heating demand, there has been a prolonged period of cheap natural gas. Even though natural gas prices have been slowly rising over the past few years, the industry has been wondering whether natural gas prices will ever rebound to the historical levels seen between 2006 and 2008. Now, with growing demand across the United States power markets and significant environmental regulation likely, natural gas prices are expected to rise over the next one to two years – a significant upswing in current price trends.

Cheap Gas Drives Demand Growth

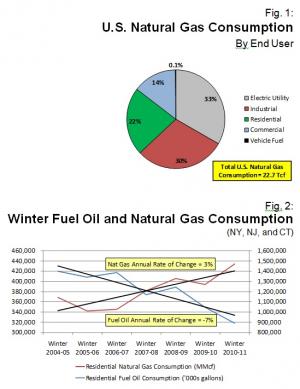

More than 80 percent of natural gas consumption in the United States is by electric utilities, industrial customers, and residential customers (see Figure 1 on p.2). Recent indicators show growing natural gas demand by residential and industrial customers.

Coal retirements and fuel shift to natural gas represent a 25 to 35 percent increase in consumption over current annual consumption levels.

For example, in the Northeast where there is significant consumption of heating oil during winter months, cheap gas has been driving customers to convert their heating units to natural gas over the five years since the peak of gas prices during 2005 and 2006. Figure 2 (see p.2)provides an indication of this fuel switching trend in the residential customer segment as a steep decline in fuel oil consumption during the winter months has been coupled with a corresponding increase in natural gas consumption over that same period.

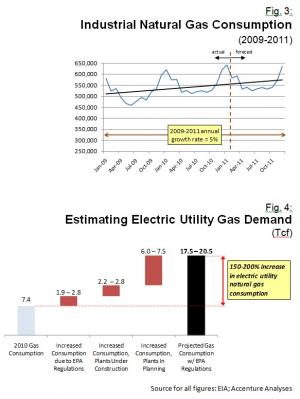

Also, despite technology developments and corporate emphasis on energy efficiency over the past years, natural gas demand in the industrial segment is also growing more than 5 percent per year since 2009.

Power Consumption: 3x in 10

The largest natural gas consumer in the U.S. is the electric power industry where 2010 consumption levels around 7,400,000 MMcf accounted for more than 30 percent of total U.S. consumption (see Figure 1 on p.2). Now, new generation build and pending EPA regulations have the potential of driving the closure of many coal facilities across the United States. Industry estimates are in the range of 60 GW of capacity that may be retired due to these regulations. The most likely alternative in the short and medium term would be to shift this generation from coal to natural gas.

Using a simple scenario where natural gas is the “clean” fuel of choice and using average assumptions around capacity factors for retiring coal plants and efficiency levels for an average natural gas power plant, these coal retirements and fuel shift to natural gas represent a 25 to 35 percent increase in consumption over current annual consumption levels that are around 7.4 Tcf.

The true wild card is the more than 170 GW of new gas-fired capacity in planning.

In addition to this fuel switch, significant new natural gas generation capacity is under development across the United States, with more than 70 GW under construction. The true wild card, however, is the more than 170 GW of additional capacity that is in planning. Figure 4 (see p.2) estimates the natural gas consumption that will be needed to fuel this new natural gas generation capacity – between 2.2 and 10.3 Tcf per year, depending on how much of the planned capacity is expected to come to fruition.

Cheap Gas Drives Demand Higher

When the aforementioned growth in electric utility natural gas demand is coupled with current growth projections across the residential and industrial customer segments, the result will be the doubling or tripling of natural gas demand over the next five to 10 years. Natural gas supplies will clearly be stretched to the limit.

Even with recent large natural gas discoveries, significant technology advances, and higher-than-average inventories, the supply of natural gas is not elastic enough to handle the price impact of significant demand increases. As a result, as natural gas prices rise, the economics of environmental compliance investments for coal plants will also change. The result will be to push coal back into the money despite very high costs for compliance with potential EPA carbon emissions limitations and requirements.

Gas prices likely will rise in the short term. The real questions are how high and how fast?

In any event, the prospects for increased natural gas consumption in the utility sector are enough to indicate that gas prices likely will rise in the short term. The real questions everyone should be asking are how high and how fast?

ABOUT THE AUTHORS: Dan Krueger (daniel.p.krueger@accenture.com) is a senior executive in Accenture’s utilities practice and the global head of generation and energy markets. Andre Begosso (andre.p.begosso@accenture.com) is a senior executive in Accenture’s utilities strategy practice. Curtis Bech (curtis.h.bech@accenture.com) is a manager in Accenture’s utilities strategy practice.