What's Solar Really Worth?

As the competition for commercial and utility scale photovoltaic (PV) projects increases, a better method for comparing proposal prices is needed to accurately value each offer. Currently, a common practice is to evaluate projects on a dollar-per-watt ($/W) basis, either DC or AC. This assumption is only valid as long as all the proposals have their DC or AC system sizes the same. However, due to the complexity of PV performance modeling and the lack of industry standards, companies size their systems differently based on the modeling and the needs of the customer. As a result, using $/W DC or total dollar value doesn’t always provide an accurate comparison of value.

Using dollars-per-watt or bid total doesn’t always provide an accurate comparison of value.

For any residential, commercial, or utility project, there can be anywhere from a few bidders to hundreds of bidders. After evaluating a potential bidder based on quality, the four main parameters in which proposal prices will vary are Watts DC, Watts AC, kilowatt hours (kWh), and total offer price. Frequently, customers will only specify a required price for one or sometimes two values. It’s only natural to attempt to create a common metric for comparing all of the bidders. Typically, this is done either by dividing the offer price by power of the system (DC or AC) and generating a $/W DC or $/W AC price. However, condensing the complexity and intricacies of a power plant to one metric doesn’t allow a customer to accurately compare projects. The customer should understand that and relate to potential bidders how they will value the project, and price it accordingly. Additionally, as many parameters as possible should remain unchangeable.

Pricing Parameters

When purchasing and evaluating PV modules, it’s appropriate to use $/W DC. This is because a module’s value is found in the wattage that it can produce. With the same technical specifications, the customer would be justified in selecting a module priced at $1.50/W DC versus one priced at $1.60/W DC. For a 1 MW DC project, this would relate to a cost savings of approximately $100,000. However, using the $/W DC comparison is no longer adequate when evaluating a proposal for the entire power plant system, because the intrinsic value for the system varies from component to component and customer to customer.

There’s efficiency in scale; the incremental cost to do additional work decreases as the magnitude of work increases.

The costs for racking equipment illustrate the shortcomings of the $/W DC comparison. For a particular project, assume that each rack needs to hold 20 modules and the customer requests that each supplier provide quotes on a $/W DC to save time. The following bids are received:

All three companies are equal in terms of quality and reliability. Naturally, one would select Company 1. However, upon further investigation each company’s assumptions are revealed:

With this information, it becomes clear that the preferred supplier is Company 2:

The pitfall of using a $/W DC basis in selecting equipment other than modules relates to the value that the equipment serves. Additionally, installers will price their labor as $/W DC. That might seem logical, because as the DC wattage increases by adding modules, the associated labor should increase. But this approach presents two main concerns. The first is that labor costs aren’t linear when increasing or decreasing the size of the project. There’s a startup cost for any labor work regardless of project size. Also, as there’s efficiency in scale; the incremental cost to do additional work decreases as the magnitude of work increases.

A second concern with pricing labor arises from assuming that the DC size changes by adjusting the module count. However, the DC size can increase or decrease based on the actual module wattage delivered to the site. There’s no change in installation labor for installing two equally sized modules where one is 275 W and the other is 280 W.

Accurately modeling and estimating the energy (kWh) performance of a PV power plant is a strong competitive advantage for any company. The final size and price of a project is dependent on the energy delivered to the site. However, various companies model their delivered energy differently.

Projects should be compared first with the parameter that brings the greatest intrinsic value.

Comparing projects on a kWh or a $/kWh basis has inherent risk in that the actual energy produced won’t be known until a year after commissioning. Stipulating modeling parameters is impractical as it eliminates the competitive advantage that some companies have by either proposing unrealistic parameters or by mining insider information that more established companies have taken years and significant cost to develop. The most practical way to avoid such risks is to require a performance guarantee on the project, to be enforced by liquidated damages provisions or similar mechanisms.

Valuing Performance

It’s unrealistic to compare projects based on a single parameter. But projects should be compared first with the parameter that brings the greatest intrinsic value. That means customers must understand what they value most from the project, whether it’s power, energy, or absolute price, and evaluate accordingly.

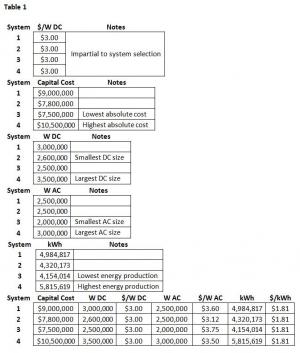

The internal evaluation by the customer is very important. Asking bidders to state the price a certain way might lead to improper assumptions. Instead, the customer should take the overall price and calculate the $/W DC, $/W AC, and $/kWh independently to ensure proper comparisons. Using all four metrics of total dollars, $/W DC, $/W AC, and $/kWh is essential to producing an accurate evaluation. This is illustrated in the example shown in Table 1. The only specification listed in the RFP is that the size of the system can’t exceed $3.00/W DC. This example illustrates how a $/W DC value doesn’t paint an accurate picture, even given the same basic assumptions for each bidder.

If each each aspect of the project were considered separately, the customer would choose a different system every time depending on the goals of the project. System 3 has the lowest capital cost but the

largest $/W AC; System 2 has the lowest $/W AC but a relatively low energy output; System 4 has the highest energy output, but the highest capital cost; and System 1 is never the highest or lowest in any category.

It can be dangerous to only look at one parameter when selecting a project as opposed to evaluating all aspects of the project. Vetting each proposal isn’t easy, but it is necessary to understand everything that’s being offered. By focusing in on only one area, the customer might end up paying more later, by not properly understanding the parameters of all the proposals.