Up in Smoke

In May, PJM Interconnection conducted its annual auctions to secure electric capacity three years from now. As expected by most analysts, the base residual auction (BRA) for delivery year 2014/15 electric capacity cleared with lower volumes versus the prior year, due to lower demand. Prices were lower in the typically constrained eastern Mid Atlantic Area Council (MAAC) region, and higher in the rest of the regional transmission organization (RTO). Directionally, these intra-PJM price variations were anticipated due to the construction of west-to-east transmission facilities, the impact of the economic downturn on demand in the constrained eastern region and the effect of recent EPA rulings on generator retirements.

However, there was a surprise in the way these effects interplayed, as well as in the contribution of demand response into the dynamics of the market. Prior to the auction, analysts expected some amount of old or otherwise dirty coal fired generation to exit the market altogether, and for others to bid high prices to recover environmental capital expenditures required to comply with EPA requirements under the Clean Air Transport (CATR) rule of June 2010 and the National Emissions Standards for Hazardous Air Pollution (NESHAP MACT) rule of March 2011.

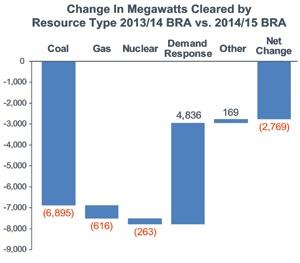

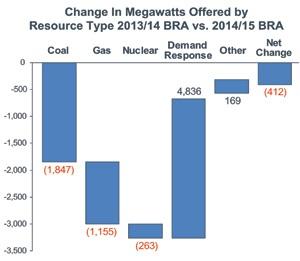

Both of these expectations came to fruition. Compared to the prior auction, 1,850 MW of coal fired generation, enough to power more than 600,000 homes, was withdrawn from the market. And it didn’t stop there. By the time the auction was over, 6,900 MW of coal fired generation from the prior year -- or enough coal capacity to power more than 2.2 million homes -- was out of the market because prices at which they bid -- as a result of environmental capital expenditure requirements -- were higher than where the market cleared.

Cleaner Market

While the removal of these coal plants undoubtedly resulted in higher capacity prices than if the plants were in, it led to significant environmental benefits.

PJM reported that demand response contributed 30 percent to the price reductions in the constrained region.

If these plants share the same characteristics of a typical PJM region coal plant, according to EPA’s eGrid database they would have operated 59 percent of the time in the delivery year, and produced approximately 36 million tons of carbon dioxide equivalents (CO2e). In global warming terms, eliminating this amount of greenhouse gas emissions is equal to removing about 7 million passenger vehicles from the U.S. vehicle fleet. In addition, the plants would have produced 228,000 tons of sulfur dioxide and 59,000 tons of nitrogen oxides -- precursors to acid rain and contributors to a host of pulmonary and other health problems.

Using the market mechanism to generate the replacement sources for the coal capacity resulted in significant economic benefits, measuring from a baseline of the cost to retrofit the coal plants. As coal plants’ costs rose due to EPA-mandated retrofits, the new resources replacing them -- including other traditional generation, wind and solar, and most significantly, demand response -- held market prices in check. Demand response contributed an additional 4,800 MW of cleared capacity above the prior auction year. Indeed, PJM has reported that demand response mitigated unconstrained region-clearing price increases by 10 to 20 percent, and contributed 30 percent to the price reductions in the constrained region. These percentage savings translated to about $1.2 billion in direct payments to capacity providers.

Demand response is an outgrowth of market innovation and smart grid technology. Operating under market constructs that introduce variable demand into energy markets, demand response providers search for the most economic megawatts available for curtailment and build networks of sites utilizing intelligent energy management to generate “negawatts,” which represent the ability of end users to reduce or eliminate energy consumption in response to signals. By making negawatts available at costs that are generally below those required to build and maintain generation plants, demand response lowers capacity costs in energy markets and offsets new build capacity.

Demand-Side Potential

According to FERC, there are currently about 37,000 MW of demand response capacity available in the United States.

Demand response providers will pay back more than $300 million to end-use customers in the PJM region in 2014/2015.

FERC further estimates that given the right market constructs, this capacity could grow to between 80,000 MW and 108,000 MW by 2030, permanently eliminating the need to build power plants to serve that demand. PJM, with demand response registrations of 9,200 MW in 2010/11 and cleared demand response of 14,100 MW by 2014/15, is the largest demand response market.

In addition to providing overall costs that are lower than traditional fossil fueled generation, such as coal plants in the auction, demand response will provide additional benefits to electricity consumers in the PJM region. Demand response provides payments directly to end consumers who agree to curtail their energy use. While varying widely depending on technical and market factors, these payments or “customer splits” average 50 percent or more of the gross revenues provided by the PJM capacity market. This means demand response providers will pay back more than $300 million to end-use customers in the PJM region in 2014/15, on top of the $1.2 billion already saved by consumers.

The prices at which coal-fired plants bid were higher than where the market cleared -- as a result of environmental capital expenditure requirements.

Customers receiving these payments often use them as leverage for capital expenditures on energy management and other energy efficiency projects, which helps generate “green collar” jobs. As these customers eliminate or reduce consumption when called upon for grid events, their action has a concomitant effect on real-time wholesale electricity prices in the energy markets, further lowering costs and reducing peak-time pollution.

The success of consumer-side participation in the PJM capacity markets clears a path for succeeding in the long sought trifecta of winning policy as it relates to the environment, energy and economics.

About the Author:

About the Author:

Ade Dosunmu is managing director at Capacity Markets Partners. Previously he held executive positions at Utility Risk Management Corp., Comverge, and Booz & Co. He co-founded GreenPrimate Inc., a provider of automated building energy efficiency software and services. He holds an MBA from Stanford Graduate School of Business and a BSc in Mechanical Engineering from the University of Ife. Contact him at adosunmu@capacitymarkets.com