Ratcheting Down

Once a standard for long-term corporate bonds, the call feature seems to have fallen out of favor. Among electric utilities, where debt is a dominant part of the capital structure, virtually every 30-year bond used to be callable after five or 10 years. These structures gave issuers the advantage of being able to reduce interest expense if rates declined, by calling the bonds and refunding them at lower coupons.

Over the last 20 years, competition among bond underwriters for deal volume led them to promote plain vanilla, optionless bonds instead of callable bonds, on the grounds that they are easier to sell — investors are assured of a fixed rate for the life of the bond. Issuers went along without complaint. But the long-term consequence of abandoning callable bonds has been expensive: today the average price of electric utility bonds is around 120 percent of par, because they are paying much higher than prevailing interest rates. Consumers in turn are penalized, as regulators have allowed utilities to pass on the higher financing costs.

Among investor-owned utilities, a couple of notable exceptions who continue to issue callable bonds from time to time are Alabama Power and Georgia Power. The call options in their debt portfolios shorten duration, making them less sensitive to declining interest rates. Consequently the prices of these issuers’ bonds are well below the industry average.

Within the electric sector, there is another group whose bonds aren’t at a high premium. These are the lower-rated companies who can’t issue long-maturity (i.e., 30-year) bonds due to a lack of investor appetite. Thus falling interest rates haven’t hurt them as much as their higher-grade peers. PNM Resources, where the longest bond outstanding is less than 10 years, is one such example.

One issuer has taken another approach: ratchet bonds. This innovative structure goes one better than callable bonds when it comes to taking advantage of lower interest rates. Ratchet bonds save money when rates fall, while holding coupons constant when rates rise. Savings happen automatically, with no transaction costs, which makes ratchet bonds an attractive alternative.

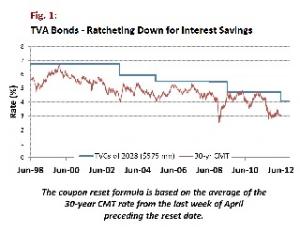

The Tennessee Valley Authority issued two ratchet bonds in the late 1990s. The considerable interest savings generated by these bonds before, during, and after the financial crisis, contributed to lower electricity rates for TVA’s customers. How do the TVA ratchet bonds work? Their coupons reset annually to the 30-year CMT, or constant maturity treasury rate, plus a fixed spread, but only if the resulting coupon is lower than the current coupon. There’s no reset if the resulting coupon is higher.

The TVA Experience

TVA followed up in 1999 with a 30-year, $525 million, 6.50 percent ratchet issue (TVE, NYSE) with a reset spread of 84 basis points. The coupon on these bonds was reset to 4.15 percent as of May 1, 2012 — representing an annual savings of 2.35 percent relative to the original coupon of 6.50 percent.

The savings to date make TVA the envy of its peers, and the savings might increase if Treasury rates decline further — the bonds have many remaining reset opportunities before they mature. But even if there are no further resets, the average coupon on the TVCs over their life will be 4.89 percent (1.86 percent below the starting coupon of 6.75 percent), and the average coupon on the TVEs will be 4.81 percent (1.69 percent below the starting coupon of 6.50 percent). Of course there’s no free lunch; in order to include the ratchet feature, TVA had to pay about 50 basis points above its comparable-maturity optionless rates at the time. Today, given the shape and level of the yield curve, the premium would be much smaller.

Saving Money (and Embarrassment)

How would TVA’s peers have fared if in 1998 and 1999 they’d issued ratchet bonds, instead of the actual $7 billion optionless long-term bonds with an average coupon of 7 percent? According to our estimate, they would have saved around $2.7 billion over the life of the bonds, and would have avoided the embarrassment of having their bonds trade in the 120s.

Naturally they would have done reasonably well if they’d issued callable bonds, but the superiority of ratchet bonds is evident. Unlike automatically ratcheting bonds, callable bonds must be managed. Back when callable bonds were the norm, many corporate treasurers missed the boat when rates dipped, or called too early only to see rates decline much further. As a result, potential savings were often left on the table.

But even assuming that the bonds are called optimally, there’s a cost associated with re-funding bonds — underwriting fees, etc.. The cost adds up over several call-refunding cycles. In contrast, ratchet bonds effectively re-fund themselves at lower rates on autopilot. No management is needed and no transaction cost is incurred. And issuers avoid the risk mistiming their bond calls when they try to capture interest rate savings.

ABOUT THE AUTHOR: Andrew Kalotay is president of Andrew Kalotay Associates, which provides debt management and bond valuation services. Kalotay has a PhD in mathematics from the University of Toronto and has been named to the Fixed Income Analysts Society’s Hall of Fame.