Risk Management's Existential Crisis

Risk management is entering its third decade as a formal discipline – its methodologies and supporting technologies have never been stronger, yet major risk management debacles keep occurring. High-profile examples include not only banking firms, but also energy companies and other firms that engage in commodities trading. Are risk management practices fulfilling their purpose for utilities and other companies in the power and gas industries?

Recent risk management debacles share some common themes, which suggests risk management systems and methodologies haven’t evolved to prevent such failures. In many trading shops, risk management is a junior partner to commercial personnel who have asymmetrical incentives, that is, to “over-risk” the firm in pursuit of large bonuses instead of adhering to the firm’s stated risk appetite. As a result of this uneven balance of power and distorting incentives, risk management as a discipline has, to-date, not fulfilled its mandate. The best solution might not be to write new policies and standards, but instead to change the structural incentives for risk management professionals.

Recent Risk Management Failures

On April 30, Jamie Dimon, CEO and chairman of the board of JP Morgan (JPM), bellowed at his subordinates. He had just reviewed position reports that showed losses up to $5 billion.1 10 days later JPM – a firm with a reputation as a world class risk manager which sailed through the 2008 mortgage crisis relatively unscathed – announced losses of between $2 and $5 billion, caused by what’s now widely considered as a badly executed and poorly managed hedge.[1] JPM’s stock slid 18 percent in the next 10 days erasing $27 billion of market value and its debt was downgraded from A plus to A minus. The Department of Justice, FBI and Congress initiated investigations. The full extent of JP Morgan’s losses still aren’t known, but the estimate has risen well beyond $5 billion.

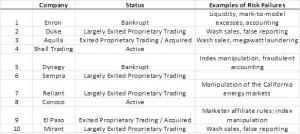

Fig. 1: What Happened to the Top 10 Energy Traders by Volume in 2000

Source of Ranking: Platt's Gas Daily

On Dec. 8, 2011, Jon Corzine, a man rich with honors and accolades – including being ex-CEO of Goldman Sachs, a former U.S. senator and governor – sat testifying before a U.S. congressional committee trying to explain why his current firm, MF Global was bankrupt and over $1.2 billion of customer money was missing.

On Oct. 6 2008, Lehman Brothers CEO Dick Fuld testified before the United States House Committee on Oversight and Government Reform regarding the causes of the bankruptcy of his 158-year-old firm.

And in July 2007, Bear Stearns CEO James Cayne busied himself playing in a bridge tournament without a cell phone or email device as his firm began to collapse, sparking the start of the 2008 global credit crisis[2].

Each of these once highly respected leaders was pummeled by risk management failures, and their firms lost billions of shareholder dollars. But they are by no means alone. The rise of derivative trading has been shadowed by a corresponding and ever-growing graveyard of the unlucky with poor risk management practices.

The Maginot Line of Risk Management

The power in trading shops lies with the traders. Risk managers, regardless what the policies say, do not hold equal stroke to the front office. Traders make money for the firm, get the big bonuses, and have the alpha personality characteristics to dominate.[3] Risk managers on the other hand are paid less and are often viewed as a cost center at best, and at worst as an impediment to trading profits.

Consider the examples of JP Morgan, MF Global, and a few others.

At JPM, Irvin Goldman, the risk manager responsible for the business unit which suffered the multi-billion dollar loss had no risk management experience. Additionally, Goldman was found guilty of compliance violations while working as a trader for Cantor Fitzgerald which led to a $250,000 fine and Goldman’s departure from Cantor. Goldman was hired as a divisional head of risk management with help from his brother-in-law who oversaw risk management for all of JPM.[4] His hiring led to senior risk management staff resigning in protest.[5]

Further, in early 2012 JPM’s risk team inappropriately modified the portfolio’s value-at-risk (VaR) model, which dramatically understated its VaR.[6] Bloomberg reported: “The new formula showed average VaR for the chief investment office stood at $67 million, according to a regulatory filing on April 13, the day JP Morgan reported first-quarter results. When JP Morgan reverted to the old model, it showed the average VaR was $129 million, and that the figure ballooned to $186 million at the end of the period, a May filing showed.” [7]

In retrospect, Dimon called the new VaR model “inadequate” and commanded that the previous model be reinstated.

The risk team also failed to catch that the JPM trading team was mis-marking its deals, hiding hundreds of millions of dollars of losses.[8] Additionally, the team allowed JPM’s traders to eliminate previously enforced stop loss limits. Overall, it was reported that management “appeared to have started paying less attention to the details of the group’s trading activities amid its hefty profits.”[9]

Of course, risk management does not totally rest in the mid-office. The front office has a responsibility to police itself as a first line of defense. Specifically, the trading manager is responsible for overseeing positions and strategies. The trading manager at JPM, Ina Drew, evidently failed in this regard. Drew was absent while the toxic positions were being accumulated due to a bout of Lyme disease and failed to adequately delegate her authority. As a result, the group’s morning meetings reportedly were highly dysfunctional and were regularly punctuated by shouting matches between her lieutenants.[10]

A former trader in the group was quoted as saying, “There was a lopsided situation, between really risky positions and relatively weaker risk managers.”[11] In fact, the first warning CEO Dimon had of the impending fiasco was not from his own risk group, but rather from a story published in the Wall Street Journal on April 6, 2012.[12] Again, this all occurred at a firm widely known for its best-in-class risk management operation.

At MF Global, the chief risk officer, Michael Roseman, who tried to warn MF Global’s board about the extreme risks of the overly large trades that were being executed, was fired by CEO Jon Corzine and replaced with a more pliable individual. Reports state that Corzine was annoyed by Roseman’s “dour attitude and persistence.”[13] The new chief risk officer observing the fate of his predecessor was much more accommodating in representing the risk of the company’s’ trades to the board.[14]

At Lehman Brothers, risk management was thrown to the wind in the pursuit of trading profits. An analysis by the Stanford Law Review stated: “Lehman Brothers consistently ignored its own risk thresholds through its commercial real estate investments. In July 2007, for example, 30 real estate transactions breached the individual transaction risk limits established by the bank’s risk managers. Each time, Lehman Brothers’ senior management waived the breach. In addition, the bank’s stress testing omitted the inclusion of its riskiest assets, its commercial real estate portfolio.”[15]

And the story goes on and on. Whether it is at Société Générale that neglected to monitor internal alerts and segregate system rights, allowing Jérôme Kerviel to rack up unauthorized trading losses of $7 billion,[16] or UBS that suffered $2 billion from a rogue trader, where its risk management group did not act on flags of unauthorized trading,[17]or Barings, or Daiwa Bank or Sumitomo Corp., or Irish Allied Banks.

All too frequently, risk management is reminiscent of France’s Maginot line – the massive line of defenses famous for failing to stop the German invasion at the start of World War II. Just as the Germans ran around the edge of the supposedly impenetrable Maginot line, traders have demonstrated their capability to outwit or bully the risk management systems and personnel put in place to monitor and restrain the reckless gambling away of other people’s money.

Energy Risk Management in Comparison

Energy risk managers should not feel too smug that all the above examples were financial institutions. Energy trading shops in the U.S. power and gas industries have a history of risk management failures as well. Enron is the obvious example, but others include storied names in the investor-owned utility industry, such as Duke, Aquila, El Paso, and Reliant. Only two of the top energy traders from 2000 are still active in proprietary wholesale trading, the remainder exited or bankrupt, beset with risk management and compliance failures (see Figure 1).[18]

Recent history has continued this trend. There is the 2006 bankruptcy of Amaranth, a firm that once controlled half of the natural-gas market,[19] which lost $6.5 billion dollars over a couple of weeks. BP, one of North America’s largest energy traders, was fined $300 million in 2007 for market manipulation which should have been readily apparent to its risk team.[20]

And most recently, a story has circulated through the energy risk community of a super major trader which fired its head of accounting for a $50 million P&L bust in its oil trading unit resulting from bad excel spreadsheets (i.e., model risk). This same firm also fired its CFO of gas and power trading, as a result of a $100 million P&L bust resulting from mark-to-model errors, detected but not corrected until natural gas prices plunged. Both types of model risk had been highlighted previously by its operational risk group, but largely ignored by the commercial and risk leadership.

Traditional Risk Management Falls Short

Risk management has become a mature discipline over the last 25 years. Its methodologies, models, and systems have never been more powerful. Most risk managers are smart, hard-working individuals who are doing their best. However, risk management debacles keep occurring at a regular pace both in the banking and energy industry.

The underlying issue is that in most trading shops, the bias is for risk managers to operate in a subordinate position to the front office. Moreover, traders have asymmetrical incentives – that is, the best case of over-risking a firm is a multi-million dollar bonus, while the worst case is to be fired and have to move to another firm. Examples abound of traders who have been fired for huge losses and found similar employment elsewhere. This asymmetrical incentive motivates them to over-risk and skirt stated risk policies to drive outsized profits.

Risk managers implicitly understand that their career progression depends on not stepping in the way of these profits. Risk managers who do not get along with the traders are not viewed as successful, and many ambitious risk managers often ingratiate themselves with the front office with the hope of a future transfer into the front office – and a higher salary. Also, many risk managers may be limited in their ability to aggressively chase warning signs due to insufficient gravitas. Gravitas in this case, being a function of having parity of knowledge with the front office on the markets, organizational stature, and the self-confidence to be confrontational when appropriate.

Investors should not be complacent when a trading shop’s management speaks to the rigor of its risk management function in protecting shareholder dollars. As detailed above, risk managers have a spotty track record in identifying and escalating firm threatening risks. Even when they do, they may be fired for being overly aggressive, as in the case of MF Global.

This issue is structural within the culture of many trading shops. The solution is not to write more risk policies and procedures, but to address the fundamental cause of these risk management debacles – that is, the asymmetrical outcomes offered to risk-seeking individuals playing with other people’s money.

There is not a single solution to this state of affairs. One approach that is gaining traction is deferred bonus payments. Under a deferred bonus system, a portion of variable compensation is held back for a period of time to discourage destructive short term behavior. The Financial Stability Board, an international body that monitors and makes recommendations about the global financial system, recommends that 40 to 60 percent of variable compensation for senior executives, material risk takers and high earners should be deferred over a number of years, in line with the risk profile of the business. A recent study found that the share of the bonus pool which is deferred has nearly doubled to 43 percent from just 23 percent in 2007, and that the vast majority of these programs have vesting periods of three years or longer.[21]

Deferred bonuses is a reasonable start, but should be reinforced with the ability to claw back past compensation from reckless traders. 84 percent of Fortune 100 companies had some form of clawback provision by 2011, up from 18 percent in 2006. To date, companies have been loath to use this new power due to potential legal issues.[22] However, this may be changing. The Dodd-Frank financial reform law has expanded the types of behavior that can be subject to clawback, which were originally defined by the Sarbanes-Oxley act.

Trading shops should consider instituting stringent multi-year clawback provisions – both for bonuses and base compensation – for traders found to have abused the letter or spirit of the firm’s risk appetite or policies. A strong clawback provision removes a reckless trader’s incentive to over-risk the firm for the sake of a near term bonus, or to hide toxic trades that the trader believes will not come to light before he leaves the firm.

The clawback, while not a silver bullet, helps address the root issue of trading debacles. These clawback provisions should reach down from the most junior analyst with authority to transact to the most senior executives who set the compliance and risk culture for the firm. An effective clawback program helps normalize incentives and complements existing risk management controls in order to stop future trading debacles.

ABOUT THE AUTHOR: David Foti, FRM, PMP is a professor of economics at Lone Star College and president of Foti LLC, an energy risk consultancy. He has 20 years' experience working with energy traders and has held management positions at Enron and BP. He can be reached at david.foti@lonestar.edu

1) "J.P. Morgan’s Big Loss: Lessons From a Fiasco,” Wall Street Journal, May 15, 2012.

2) http://money.cnn.com/2007/11/01/news/companies/bearstearns_ceo/index.htm

3) CFA magazine reports that 1 in 10 traders exhibit psychopathic tendencies, compared to 1 percent in the general population. "The Financial Psychopath Next Door", CFA magazine, March/April 2012.

4) “Risk Manager’s Past Scrutinized,” Wall Street Journal, May 21 2012.

5) “JPMorgan’s Iksil Said To Take Big Risks Long Before Loss,” Bloomberg, June 1, 2012.

6) “Three to Leave J.P. Morgan as Losses From Trade Increase,” Wall Street Journal, May 14, 2012.

7) “JPMorgan’s Iksil Said To Take Big Risks Long Before Loss,” Bloomberg, June 1, 2012.

8) “JPMorgan CIO Swaps Pricing Said To Differ From Bank,” Bloombeg, May 30, 2012.

9) “Inside J.P. Morgan’s Blunder,” Wall Street Journal, May 18th 2012.

10) “Discord at JPMorgan Unit Is Blamed in Huge Loss,” New York Times, May 20, 2012.

11) “Red Flags Said to Go Unheeded by Bosses at JPMorgan,” New York Times, May 14, 2012.

12) “Inside J.P. Morgan’s Blunder,” Wall Street Journal, May 18 2012.

13) “Corzine Rebuffed Internal Warnings on Risks,” Wall Street Journal, Dec. 6, 2011.

14) “MF Global Executive Is Set to Tell of Concerns,” Wall Street Journal, Feb. 1, 2012.

15) “Misconceptions About Lehman Brothers’ Bankruptcy and the Role Derivatives Played,” SLR Online, Nov. 28, 2011.

16) “Rogue Trader at Société Générale Gets 3 Years,” New York Times, October 5, 2010.

17) "UBS: Our risk systems did detect £1.3bn rogue trader," Computer World UK, Oct. 6, 2011.

18) Berry and Foti, “The Risk of Getting it Wrong,” Energy Risk, January 2010.

19) http://www.bloomberg.com/news/2011-04-21/ferc-sets-30-million-fine-for-e...

20) “BP Traders, Trying to `Corner' Market, Lost $10 Mln,” Bloomberg, July 3, 2006.

21) “Compensation Reform in Wholesale Banking 2011: Assessing Three Years of Progress,” Oliver Wyman, October 2011.

22) “An Employee Messes Up. Time to Unleash the Claw?,” Wall Street Journal, May 25,2012.