Gas Demand Response

In general, demand response refers to the ability of consumers to respond to a supply shortage by curtailing demand, thereby improving economic efficiency. Since the California energy crisis, demand response has been widely used in electricity markets throughout the United States and Canada.1 Recent developments in the natural gas sector suggest that the time may have come to also introduce demand response in that sector.

Natural gas has begun to emerge as a major fuel for power generation for a number of reasons, including environmental restrictions on the burning of coal and the establishment of renewable energy standards in many regions. The increasing role of natural gas in power generation has already begun to raise concerns about power reliability in certain regions.2 In the past, natural gas demand was relatively stable and seasonal, being largely driven by the demand for gas as a space heating fuel. As more natural gas is used for power generation, more volatility can be expected in gas markets.

Electricity markets have begun incorporating increasing amounts of demand response in an effort to assure reliable power supply at a cost that is lower than the marginal cost of building additional generators. Because of the increasing interdependence of electricity and gas markets, the time is ripe to examine more closely the opportunities to take advantage of the latent demand response potential on the natural gas side. This could enhance reliability in both gas and electricity markets at a lower cost than would be accomplished by focusing on either market in isolation.

A relatively moderate change in thermostat settings can reduce the amount of natural gas used for space heating by 20 percent.

This past winter, and then again surprisingly this summer, daily wholesale gas prices reached prices in excess of $14/MMBtu in certain markets in the Northeast.3 This is an amount that is between two and three times the $6 to $8/MMBtu paid by typical residential customers.4 Hence, it is likely that the benefits from gas demand response on a system level could be significant. Especially in the short run gas demand response may be even more beneficial in the electricity sector, where wholesale prices can swing by a factor of 10 or more due in part to the high cost of storing electricity and the need to keep the power system stable within very narrow voltage ranges.

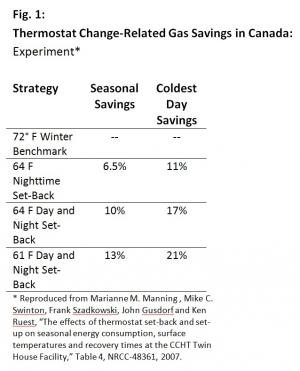

Are natural gas demand response programs technically feasible and will customers accept them? We believe the answer is yes to both questions. Results from a demonstration project in Canada featuring two identical high efficiency homes suggest that a relatively moderate change in thermostat settings can reduce the amount of natural gas used for space heating by 20 percent.5 Figure 1 shows a range of savings between 6.5 percent and 21 percent.

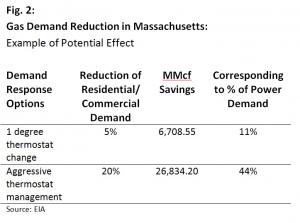

It is important to note that these results are based on a comparison of two identical new homes built to relatively strict energy efficiency standards. It is easy to imagine that average gas savings across a mix of average houses could exceed the potentials identified above. As Figure 2 illustrates for the example of Massachusetts, a 20 percent decrease in residential and commercial gas consumption in Massachusetts would free up a very significant amount of the total gas demand for power generation in the winter season.

Would customers accept natural gas demand response programs? Most likely yes, since many are already on some form of electric demand response program.6 Examples include direct load control programs for central air conditioning and water heating. With the type of smart thermostats on the market today, it would be relatively easy from a technological perspective to develop very similar programs for direct gas demand control.7 Also, California’s gas distribution utilities have received approval by the California Public Utilities Commission (CPUC) to install advanced gas meters for all their customers, providing additional opportunities for providing demand response programs down the road.8 Similar developments can be expected to occur in other states.

Would customers accept natural gas demand response programs? Most likely yes, since many are already on some form of electric demand response program.

Given that a 1 degree change in thermostat settings can lower gas demand by up to 5 percent, it is at least plausible – although there is very little data to verify this – that relatively modest participation in such programs could play an important role in relieving the pressure on regional electric markets, which itself is caused by the spike in gas demand used for space heating and hence limits supply to power generation on days with extreme weather conditions. Since the gas-electric interface has not been at the center of attention, it is likely that many regulatory and incentive issues exist that prevent a better coordination between the two markets.

It is in the interest of all those who think that natural gas should provide an increasing share of our power needs – to displace emissions from coal, to enable more supplies from intermittent renewable generation, or simply to maintain relatively reasonable rates – to explore more rigorously the potential for economical gas demand response and also to identify (and address) the barriers that currently exist and prevent gas demand response from emerging.

As a first step, it would be useful to quantify the value of demand response, perhaps using similar analytics to those that have been used on the electricity side.9 We hypothesize that this value is likely to be significant, especially in regions with strong seasonal space heating demand swings for natural gas and an increasing share coming from natural gas-fired power generation. Second, it would be useful to conduct a few well designed pilots in geographically dispersed locations to demonstrate the feasibility of gas demand response. The results should be evaluated using scientifically proven methodologies so that valid cause-effect relationships between the program and its impact on usage can be inferred. The pilot design and evaluation methodologies used in the electricity sector are likely to be transferable to the natural gas sector but some customization to the unique features of natural gas may be required.

Third, if the pilots yield positive results, a cost-benefit analysis of full-scale deployment should be carried out. Finally, if the cost-benefit analysis yields positive results, demand response programs should be introduced on a full-scale basis in gas markets.

ABOUT THE AUTHORS: Ahmad Faruqui and Jurgen Weiss are principals of the Brattle Group and can be contacted at ahmad.faruqui@brattle.com and jurgen.weiss@brattle.com. The opinions expressed here are those of the authors and don’t represent any official position of The Brattle Group.

ENDNOTES:

1 FERC, A National Assessment of Demand Response Potential, FERC Staff Report, June 2009.

2 For example, the ISO New England is currently engaged in a strategic discussions process examining a number of issues believed to threaten the reliability of the New England electric wholesale market. One of the short term issues identified by ISO New England is the increased reliance on natural gas. See for example “ISO-NE Strategic Planning Problem Statement Changes to New England Power System,” April 21, 2011.

3 “N.Y. cash hits $14.50, but NYNEX falls again,” Gas Daily, Friday, July 22, 2011

4 Based on a sample of retail rates, which range from approximately $0.56/therm to $0.78/therm. 10 therms equal one MMBtu.

5 Marianne M. Manning , Mike C. Swinton, Frank Szadkowski, John Gusdorf and Ken Ruest; “The effects of thermostat set-back and set-up on seasonal energy consumption, surface temperatures and recovery times at the CCHT Twin House Facility,” NRCC-48361, 2007

6 FERC, Assessment of Demand Response and Advanced Metering, FERC Staff Report, February 2011.

7 See for example “Web-enabled programmable thermostat,” August 26, 2009 (http://blog.mapawatt.com/2009/08/26/web-enabled-programmable-thermostat).

8 The filings in front of the CPUC show that so far the expected benefits from installing advanced meters are limited to conservation that is hoped for in response to consumers receiving more frequent information about their gas consumption. In the authors’ opinion, more information is a critical first step, but leaves out one of the more central tools available to create incentives, namely pricing.

9 Ahmad Faruqui, Ryan Hledik, Sam Newell and Hannes Pfeifenberger, “The Power of Five Percent,” The Electricity Journal, Vol. 20, Issue 8, October 2007.